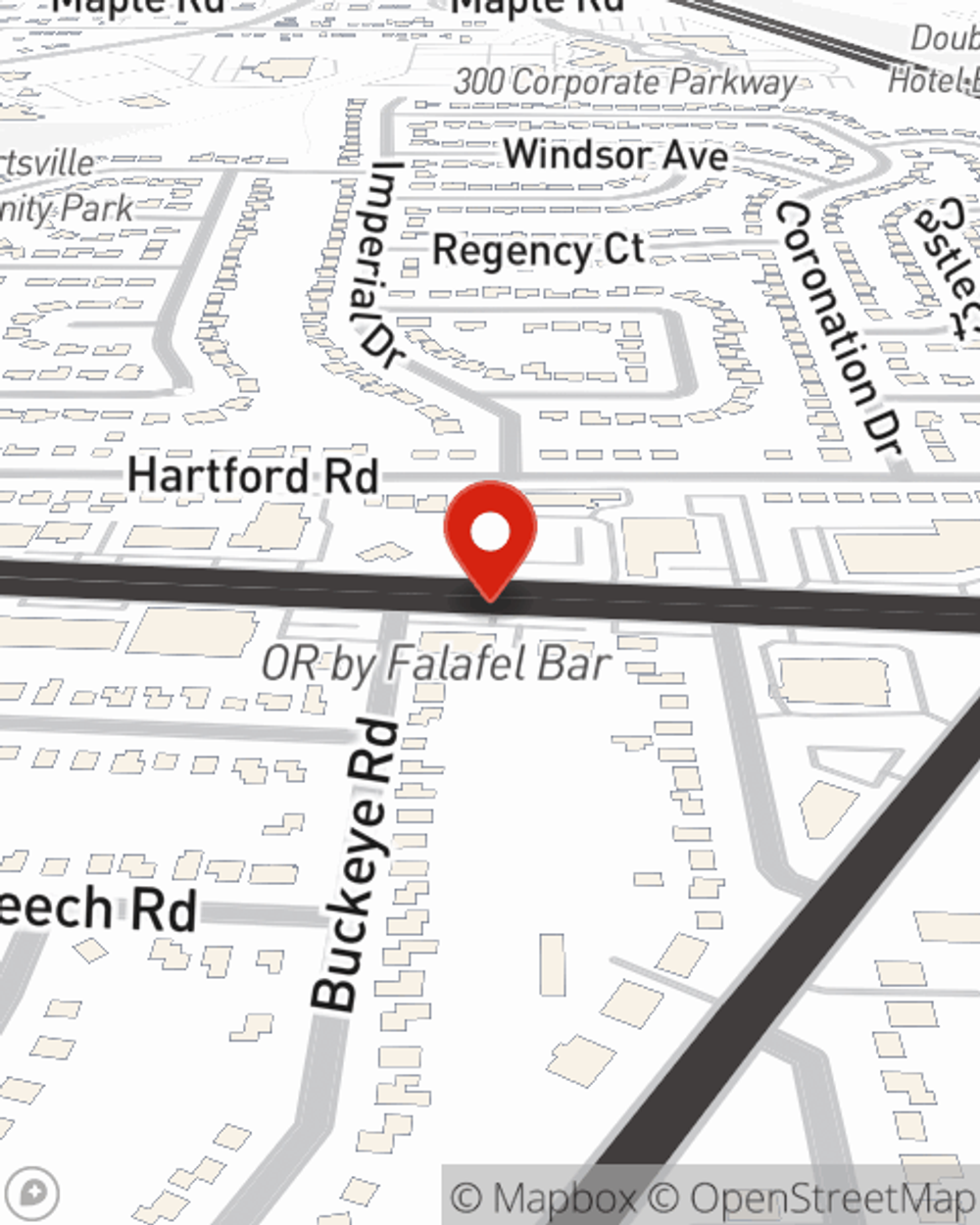

Business Insurance in and around Amherst

Amherst! Look no further for small business insurance.

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jacob Czaja help you learn about excellent business insurance.

Amherst! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cover Your Business Assets

If you're looking for a business policy that can help cover computers, business liability, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

Contact the wonderful team at agent Jacob Czaja's office to identify the options that may be right for you and your small business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Jacob Czaja

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.